The team behind PredictIt remains “committed to a future for political prediction markets,” a spokesperson told Casino.org Friday, one day after federal regulators rescinded a decision that’s allowed the online exchange to operate in the US for nearly eight years.

Late Thursday afternoon, the US Commodity Futures Trading Commission notified PredictIt organizers by letter that the exchange was not operating in compliance with the guidelines the federal regulatory body established in a “No-Action” letter issued in October 2014. The letter, sent by CFTC Division of Market Oversight Director Vincent McGonagle, said PredictIt should close or liquidate any outstanding futures markets by Feb. 15.

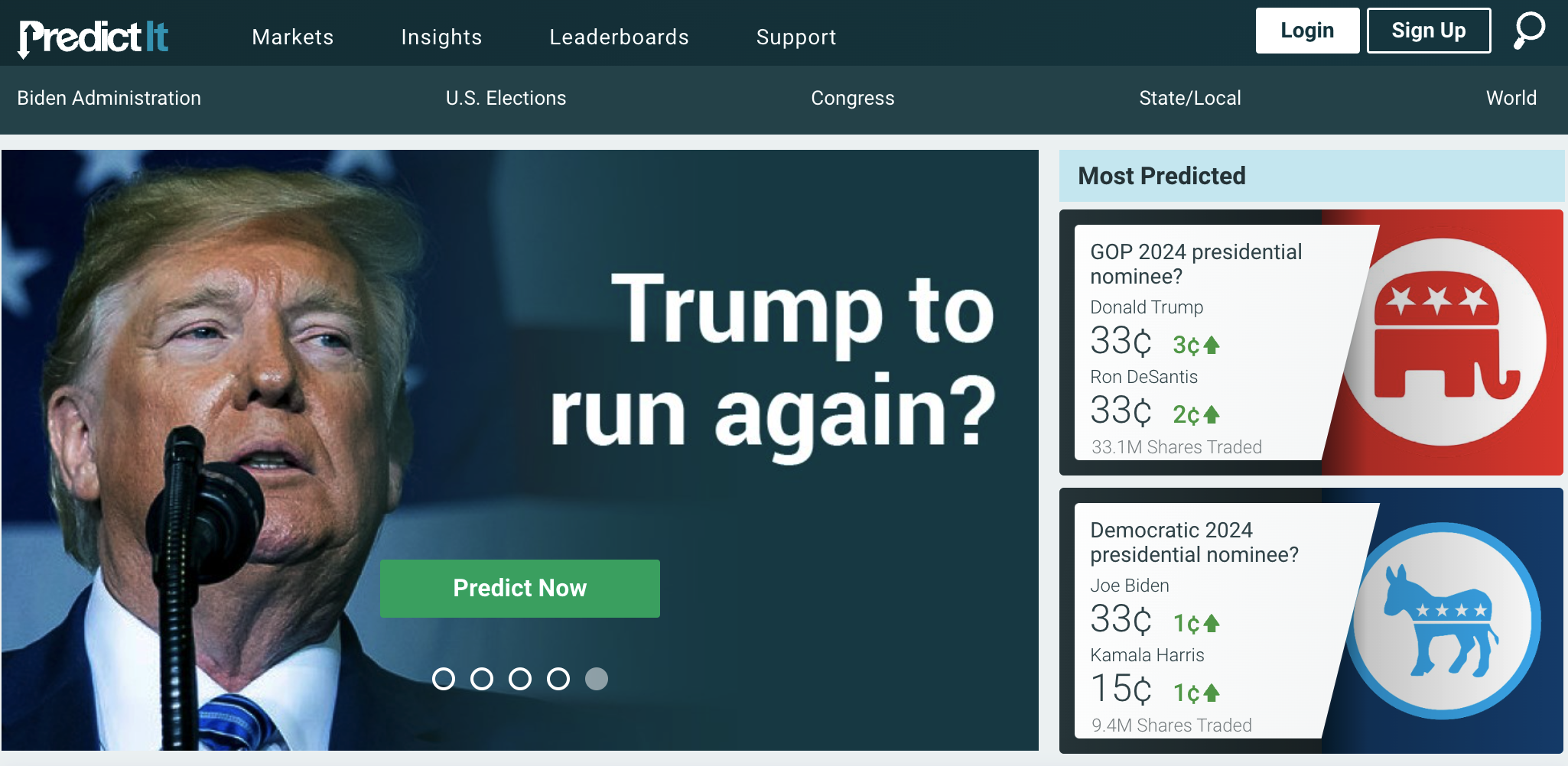

PredictIt runs an exchange where traders can take positions on future political events, such as elections and the passage of legislation. Traders buy shares for a potential outcome, and if their outcome is correct, they receive $1 for each share.

But since it’s an exchange, traders can buy or sell trades up until the event’s conclusion. That means a trader could buy shares on one outcome, potentially sell them to secure a profit, and then look to acquire shares in a competing outcome in hopes of profiting more as circumstances changes around the event.

Because wagering on political events is not allowed in US states that regulate gaming, PredictIt became the go-to site for those wanting to bet on elections, including the 2024 presidential election.

Over the past eight years, we have built a now thriving political trading community through good faith blood, sweat, and tears (and) have always strived to be a good actor in an industry rife with bad ones and have worked with the CFTC since the beginning,” spokesperson Lindsey Singer told Casino.org on Friday.

Victoria University of Wellington, a New Zealand college, created the exchange, which it set up for research purposes. The CFTC set nine rules when it gave its tacit approval for the exchange. Those rules included operating as a nonprofit exchange on a small scale, functioning solely for academic and research purposes, limiting each market opportunity to 5,000 traders, and capping each investor to an $850 investment limit per opportunity.

‘Constant Communication’

Neither the CFTC’s letter nor a statement it released late Thursday afternoon indicated a specific reason for the non-compliance determination. Donna Faulk-White, associate director for the commission’s Office of Public Affairs, told Casino.org on Friday that officials would not make additional comments beyond the letter or statement.

PredictIt representatives have had “constant communication” with the commission since launching, but “what the CFTC posted in their announcement is all we know,” Singer said.

“I can’t speak on the internal negotiations with people at the commission or their motivations,” Singer added. “What I can tell you is that we’re committed to a future for political prediction markets.”

Singer defended the exchange’s operations, saying it abides by the $850 investment and 5,000 trader limits on opportunities through coding programmed into the technology platform.

Singer added that PredictIt also performs a valuable service to a number of key audiences beyond the traders registered on the exchange.

A lot of reporters, bloggers, podcasts, other content channels, academics, politicians, and countless American voters count on this valuable data segment that will simply go away without us,” Singer told Casino.org.

Bloomberg on Saturday reported, citing unnamed sources, that PredictIt’s ties to Aristotle International – a DC-based political data, technology, and consulting firm – led to concerns within the CFTC that the exchange may not be operating as a nonprofit venture.

What’s Next?

The CFTC’s letter said that any new listings would not be covered by the “No-Action” letter, a move that prompted PredictIt to stop adding new markets on the site.

Existing markets did experience a rush in trading volumes in the hours after the CFTC’s announcement, but that has since rebounded closer to normal, according to Singer.

Since PredictIt is an exchange, anyone wishing to cash out now will need a buyer to acquire their shares.

“We really appreciate that the CFTC didn’t do this on a drop-dead basis and are allowing us to continue running a lot of markets to their natural close, and we still hope to find a way to run the 2024 markets to their natural conclusions,” Singer said.

The post PredictIt Defends Political Exchange Operations After Feds Revoke Privileges appeared first on Casino.org.